Kurt Brouwer October 21st, 2009

In my post on the $1.4 trillion budget defict ($1.4 Trillion Federal Budget Deficit), I wrote:

…Neither the Republicans nor the Democrats can claim any glory when it comes to spending control. Politicians seldom get criticized for spending our money, so they keep right on doing it. We can assign blame to different players and parties, but that still begs the question: ‘What the heck do we do?’

…We cannot run such massive deficits indefinitely on that much there is agreement. But, where is the plan for how we bring spending and revenues more closely into balance? If there is one, I have not seen it.

In response, one of my readers asked this in a comment:

So how do we go about fixing the deficit?

Answer #1: Balance the budget.

One obvious answer would be to argue for balancing Federal spending and revenues. There is one problem though, which is that we have only had something like 12 years out of the past 78 (since 1930) in which we had a balanced budget or a budget surplus. So, being a practical sort, I am suggesting that a balanced budget is a pipe dream.

As you can see from the chart below, Federal spending (red line) and receipts (blue line) have been out of balance for long periods. The pattern seems to be that deficit widens during recessions (gray bars) and narrows during times of economic expansions. However, the trend for many years — with the exception of the late 1990s — has been to be in deficit. That is, Federal spending has almost always outpaced tax revenues.

Source: St. Louis Federal Reserve

As you can see, Federal spending and revenues seldom balance. Here is the same chart covering the period 1970 - 2008:

Source: St. Louis Federal Reserve

Must we balance the budget?

It would seem that we seldom actually balance the budget and we primarily operate in a deficit. So, that begs the question: do we need to balance the budget? In terms of a family or a business, the answer is unquestionably yes because the family or the business would eventually go bankrupt when it ran out of cash to spend. Some families or businesses could last longer than others, but eventually the reckoning would come.

But, the Federal government is different because it is a permanent entity unlike a family or a business. And, it can issue debt that is backed by the government’s ability to tax us in order to pay off the debt. So, to answer the question, does the Federal government need to balance its budget, the answer is not necessarily. It might be better for monetary reasons to do so, but it’s not absolutely necessary.

If we don’t have to balance the budget, what should we do?

Answer #2: Keep the deficit in an acceptable, long-term range:

We have not balanced the budget very often, so an exact balance may not be necessary, but we should try to keep deficit spending in a range of $200 billion or less in times of economic expansion and $400 billion or so in times of recession. Over time, that range would expand a bit to keep pace with inflation.

As you can see from this chart of the deficit/surplus, keeping the deficit in a reasonable range is something we have done quite well, until recently. In normal times, keeping spending and receipts within shouting distance is doable, with a bit of fiscal restraint from our leadership. The blue line indicates a deficit when it is below zero and a surplus above zero:

Source: St. Louis Federal Reserve

Tax revenues plummet while spending soared

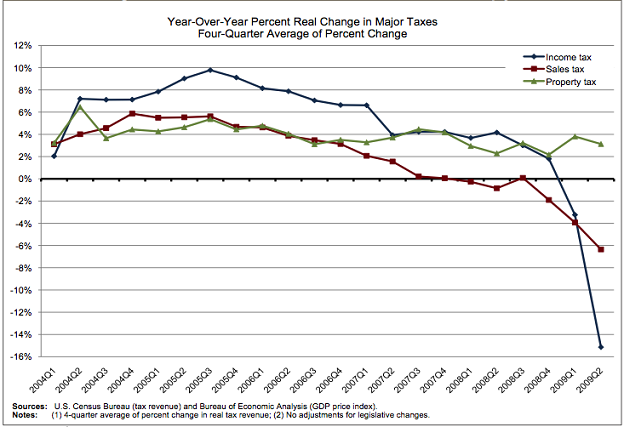

Recently, the long-term pattern of manageable budget deficits has changed — for the worse. Spending under the Republican Congress (until the 20006 elections) was largely unrestrained. Fortunately, beginning in 2003, the economy recovered and tax revenues recovered along with the economy so that the deficits were not bad. But, then the economy began falling into recession and tax revenues fell off while spending picked up. Then, with the the financial panic of 2008, economic activity cratered and tax revenues plummeted at the very time that spending went up dramatically.

Now that the recession is winding down, government spending should get cut back and tax revenues should pick up. Unfortunately, there is no sign that spending is being cut. In fact, Congress has shown no ability to cut spending or even to stop increasing it. Hence, the red line is shooting north. And, individuals are making less money and many millions are unemployed, so individual taxes are down. However, the big revenue killer is corporate income taxes. Companies have not made much money in a long time and corporate tax receipts are down about more than 50%. That hurts.

On its Tax Vox Blog, the Tax Policy Center made this point quite well:

…Corporate income tax revenues took the biggest hit, down by more than half from 2008. The deep recession wreaked havoc on corporate profits, leaving a large majority of firms with no tax liability. The consequent $165 billion drop in corporate taxes accounted for nearly 40 percent of the total revenue decline…

Source: Tax Vox Blog

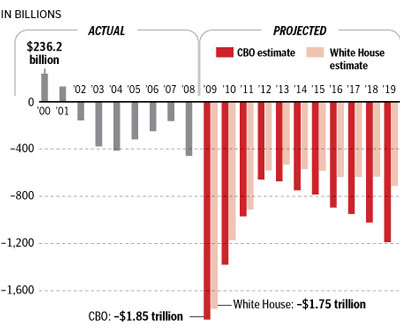

Big deficits as far as the eye can see

Tax Vox continues:

Total federal revenue in 2009 amounted to just 14.9 percent of GDP, the smallest fraction since 1950 and far below the 26 percent of GDP spent by the federal government. That gap will narrow in coming years but CBO projects that it will average more than 4 percent of GDP over the next decade, and that’s only if the 2001-2006 tax cuts expire in 2011 as scheduled. Extending those cuts, even only for President Obama’s broad middle class, will mean deficits as far as the eye can see.

Fiscal restraint

Congress controls the Federal government’s spending so Congress is the root of the problem. Or, maybe you could say that we are the problem because we elect representatives who do not focus on fiscal or spending restraint. This is not a partisan comment because it applies equally to Republicans, Democrats and Independents. Our representatives in Congress get their clout through passing legislation which means spending government dollars.

In other words, Congress is the solution as well as the problem. I believe Congress needs some kind of powerful restraint from its bipartisan spending habit. Ideally, voters would elect fiscally responsible folks to Congress, but that has not happened or it may be that life in Washington brings out the spendthrift in the best of us. Absent voters, where will the restraint come from?

Divided government & the Clinton years

As you can see, we have been in deficit for most of the past 38 years. The only time period where we were in surplus was 1997-2000, the last four years of President Clinton’s presidency. During that period we had divided government, with President Clinton (a Democrat) on one side and Congress (controlled by Republicans) on the other side.

Looking back on that time period, it occurred to me that divided government may have its merits.

See also:

Can our government borrow unlimited sums?

Government: It ain’t broke yet, but just wait

50 Ways the Feds Waste Our Money